Electric vehicle sales in India are increasing month after month, but if more quantitative evidence of the growing consumer shift to electric mobility in India is needed, it will be provided on August 10, 2023, in the form of Union Transport Minister Nitin Gadkari’s written reply in the Lok Sabha. According to data released by the Union Minister and derived from the government’s Vahan website, there are over 2.8 million registered electric vehicles (EVs) on Indian roads as of August 8, 2023 – 28,30,565 units.

The data, which represents EV sales over a 10-year period (see decadal EV sales data table below), shows the total number of registered EVs in the country’s 27 states and seven Union Territories. The overall figure will be higher because the Vahan statistics do not include EV sales from Telangana and Lakshadweep.

According to Vahan’s thorough 10-year retail statistics, India EV Inc has witnessed sales climb by 42,796% from a relatively low 2,389 units to 10,24,795 units in CY2022, a year in which the industry surpassed a million-unit sales for the first time.

With 886,959 units sold between January and August 12, 2023, EV sales this year are already 86% of last year’s record total, with a little more than four months left in CY2023. To summarize, CY2023 should set a new high of roughly 1.4 million units.

EV ownership is highest in Uttar Pradesh and Maharashtra

Given the robust growth trajectory, it begs the question of which markets in India are the most important for EV ownership. A close examination of the figures provided by the transport minister yields some intriguing results.

The top nine states, each of which has more than 100,000 EVs, account for 21,25,647 units, or an astounding 75.40% of total EVs in the country. Only Uttar Pradesh and Maharashtra have a double-digit share of EV ownership among these nine states, showing a significant level of adoption.

Uttar Pradesh (UP) has the most EVs (574,967 units), accounting for one-fifth of the total EV parc in India. This is due to the fact that UP has the most electric two- and three-wheelers. Indeed, according to recent wholesales data given by industry body SIAM for the April-June 2023 period, Uttar Pradesh topped overall car (ICE and EV) wholesales with 842,601 vehicles and 15.32% of total wholesales in Q1 FY2024.

Similarly, Maharashtra is placed second in terms of EV ownership, with 305,006 units, giving it a 10.77% share in the Indian EV market through early August 2023. Despite having half the EV parc of Uttar Pradesh, Maharashtra is expected to be the leader in electric passenger cars and SUVs, and probably among the top three states in electric commercial vehicles.

The southern state of Karnataka comes in third with 248,747 EVs. This figure, which gives it 8.78% of total EV ownership, is only 15,535 units higher than Delhi’s 233,212 units, which has an 8.23% share.

Rajasthan, located in northern India, ranks fifth with 180,670 EVs and a 6.38% market share.

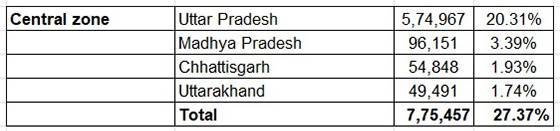

Central India dominates EV sales by zone

Central India leads the way in terms of zonal EV market penetration, with 775,457 units and a 27% share of the total India EV market, owing to the dominance of Uttar Pradesh (574,967 units and a 20.31% share). This zone is bolstered by Madhya Pradesh (ranked 11th with 96,151 units), Chattisgarh (ranked 16th with 54,848 units), and Uttarakhand (ranked 17th with 49,491 units). Expect demand for electric three-wheelers for intercity people transportation, as well as increased ownership of last-mile mobility two- and three-wheelers, to dominate this zone.

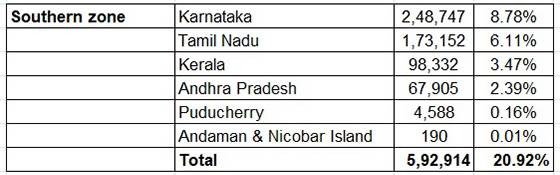

The narrative of the South Side

Southern India is increasingly where the EV action is what with Karnataka, Tamil Nadu and Andhra Pradesh housing the manufacturing operations of the leading two-wheeler OEMs ranging from e-three-wheeler market leader Mahindra Last Mile Mobility’s plant in Bengaluru to Ather Energy’s state-of-the-art 420,000-units-per-annum facility at Hosur, Tamil Madu or Hero MotoCorp’s Vida-producing factory at Chittoor in Andhra Pradesh.

The four states and two UTs, together with Kerala, account for 592,914 EVs, or 21% of the Indian EV market. Its total would have been higher if Telangana EV registration had been included in this number-crunching effort.

Tamil Nadu has already stated its aim to become the country’s EV capital, and given the pace and intensified focus of Southern India, anticipate this region to continue to offer pyrotechnics in terms of expanding EV ownership.

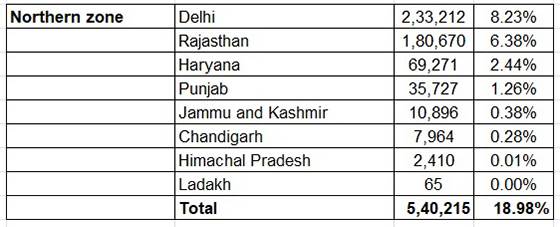

How the North Zone compares

The Northern zone has 540,215 EVs, accounting for 19% of all EVs in India. Delhi, which was among the first in the country to release a complete EV Policy in December 2019 that aims to have 500,000 EVs on the city’s roads by 2024, is nearing the halfway point with 233,212 EVs in early August.

The state of Rajasthan (180,670 units and 6.38% share), Haryana (69,271 units and 2.44% share), and Punjab (35,727 EVs and 1.26% share) are the next largest EV markets in India.

The north, particularly Delhi, Rajasthan, and Haryana, is home to the majority of the country’s almost 450 three-wheeler manufacturers, as well as the plants of a slew of e-two-wheeler manufacturers such as Hero Electric and Okinawa Autotech.

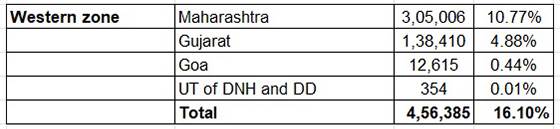

The west zone is lethal

The western zone has 456,385 EVs, which includes two main markets in Maharashtra and Gujarat, as well as Goa and the Union Territory of Dadra and Nagar Naveli, and Diu and Daman. This provides the region a 16% market share in India overall, ranking fourth after the central, southern, and northern zones.

While EV sub-segment splits are not available, it may be assumed that Maharashtra, which is the market leader in passenger vehicles and commercial vehicles according to latest SIAM wholesales data for April-June 2023, will be in the same position when it comes to electric cars and SUVs.

In terms of EV ownership by state, Maharashtra ranks second behind Uttar Pradesh with 305,006 units, while Gujarat ranks eighth with 138,410 EVs. Goa, which is witnessing good progress in e-two-wheeler sales, is ranked 21st in India in terms of EV ownership.

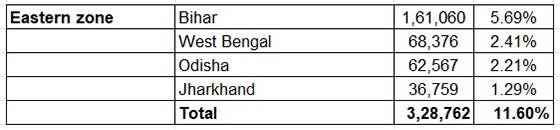

In the Eastern Zone, there are over 300,000 EVs

The Eastern zone has 328,762 EVs, with Bihar, the seventh-placed state, contributing the most (161,060 units), followed by West Bengal (63,376 units), Odisha (62,567 units), and Jharkhand.

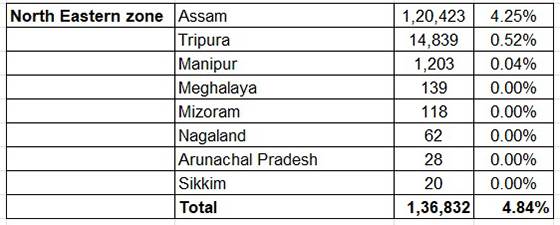

The North-East has significant growth potential

This region, which includes all eight states, has 136,832 EV users, with Assam leading the way with 120,423 units, ranking seventh overall. Assam is home to Guwahati, the North East region’s gateway and major metropolis. The region’s other states provide additional 16,409 units to the total.

INDIA’S EV INDUSTRY IS STRONGLY IN GROWTH MODE

A confluence of factors is accelerating EV ownership in India. While demand for e-mobility was tepid in the early years of the last decade, the government’s increased focus on the EV sector and the overall electric mobility eco-system in the form of the FAME Scheme and PLI (Production-Linked Incentive) Scheme for the automotive sector, as well as EV OEMs across vehicle segments expanding their portfolio, and component suppliers either developing in-house or sourcing the latest e-powertrain and parts technologies, have all contributed to the current trend.

Furthermore, rising consumer awareness of the necessity for eco-friendly transportation in the face of the destructive consequences of climate change, which has also affected India, is aiding the cause of EVs.

Furthermore, given the high prices of fossil fuels such as gasoline and diesel, as well as compressed natural gas (CNG), the wallet-friendly nature of EV cost of ownership, in the long run, is a major motivator for consumers seeking to switch from IC engine mobility to EVs.

EV-friendly legislation are another factor driving the expansion of the EV industry. Most states and UTs have notified EV policies, including Andhra Pradesh, Assam, Chandigarh, Chhattisgarh, Delhi, Goa, Gujarat, Haryana, Himachal Pradesh, Jharkhand, Karnataka, Kerala, Ladakh, Madhya Pradesh, Maharashtra, Manipur, Meghalaya, Odisha, Rajasthan, Tamil Nadu, Telangana, Uttar Pradesh, Uttarakhand, and West Bengal.

Given its quick growth, the Indian EV market is likely to make constant progress. Some issues persist, such as insufficient charging infrastructure and expensive initial EV prices, which are directly tied to battery costs.

Nonetheless, with both the private and public sectors aggressively investing in expanding the charging network across India, OEMs sharpening their focus on localisation in order to reduce costs and improve affordability, and battery prices expected to fall gradually, the industry is optimistic about the future of this eco-friendly mode of transportation, both in the short and long term.